Getting into a car accident is stressful enough, but dealing with the insurance company afterward can be just as frustrating. Insurance companies have one goal – paying out as little as possible. That is why understanding car accident settlement negotiation is key to making sure you get a fair payout. If you accept a low offer too soon, you could end up stuck with medical bills and other expenses the insurance company should have covered.

Getting into a car accident is stressful enough, but dealing with the insurance company afterward can be just as frustrating. Insurance companies have one goal – paying out as little as possible. That is why understanding car accident settlement negotiation is key to making sure you get a fair payout. If you accept a low offer too soon, you could end up stuck with medical bills and other expenses the insurance company should have covered.

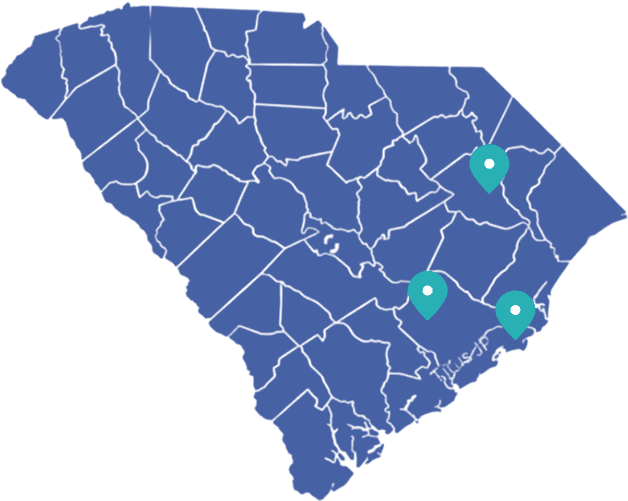

This guide will explain how to improve your likelihood of a successful car accident settlement negotiation, what tactics insurance adjusters use, and when it might be time to call a South Carolina car accident lawyer.

Understanding the Car Accident Settlement Process

After a crash, dealing with insurance can be a nightmare, but that’s where your lawyer steps in. Here’s how they handle the process for you:

- Filing the Claim – Your lawyer reports the accident and deals with the at-fault driver’s insurance company – no waiting on hold or getting the runaround.

- Investigation – They gather police reports, medical records, witness statements – everything needed to build a strong case.

- Demand Letter – Your lawyer sends a letter breaking down your damages and clarifying what you’re owed.

- Negotiations – Insurance companies love throwing out lowball offers. Your lawyer pushes back, counters, and fights to get you more.

- Settlement Agreement – Once a fair deal is reached, they handle the paperwork and make sure the check actually shows up.

- Lawsuit (if Needed) – If the insurance company refuses to play fair, your lawyer is ready to take them to court and keep fighting for what you deserve.

With a lawyer handling all of this, you don’t have to stress over insurance tricks or legal hoops – they’ve covered it.

How to Negotiate a Higher Car Accident Settlement

The insurance company’s first offer is almost always lower than your claim’s worth. Here’s how to push back and get a better deal.

Gather Strong Evidence

The stronger your evidence, the harder it is for the insurance company to lowball you. Collect everything you can, including:

- Medical Records and Bills – Keep detailed records of doctor visits, treatments, medications, and therapy.

- Accident Report – Get a copy of the police report.

- Photos and Videos – Take pictures of the accident scene, vehicle damage, and your injuries.

- Witness Statements – If anyone saw the crash, get their contact info and a statement.

- Lost Wage Documentation – If you missed work, keep pay stubs or a letter from your employer showing lost income.

Understand the Value of Your Claim

Do not just accept whatever the insurance company offers. Calculate your damages so you know what you should be asking for:

- Medical Expenses – Including current bills and future treatments

- Property Damage – The cost to repair or replace your car

- Lost Wages – Any income lost from being unable to work

- Pain and Suffering – Compensation for physical pain and emotional distress

- Future Expenses – Accounting for injuries that require ongoing care

Write a Strong Demand Letter

A demand letter outlines precisely what happened, how much damage was done, and how much money you’re demanding. It should include:

- A clear summary of the accident

- A breakdown of your injuries and medical treatments

- An itemized list of damages

- A firm but reasonable settlement amount

Be Ready for Insurance Adjuster Tactics

Insurance adjusters are trained to settle claims for as little as possible. Here is what they might try and how to respond:

- Lowball Offers – They may start with an insultingly low offer, hoping you will take it. Counter with your own demand backed by evidence.

- Delaying Tactics – They might drag things out, hoping you will get desperate and settle.

- Disputing Liability – They may try to say you were partially at fault. If you are in South Carolina, remember that the state follows comparative negligence laws – if you are less than 51 percent at fault, you can still recover damages.

- Requesting Unnecessary Info – They may ask for excessive documentation to slow things down. Provide what is necessary, but do not let them bury you in paperwork.

Stay Firm and Negotiate

When you get a settlement offer, do not accept it right away. Instead:

- Politely reject low offers

- Use your evidence to justify a higher number

- Be patient – negotiations can take weeks or even months

- Be willing to go to court (or at least make them think you will)

When to Consider Legal Representation

A personal injury lawyer can make a massive difference if negotiations fail. Here is when you should seriously consider getting legal help:

- Severe Injuries – If you have significant injuries requiring ongoing medical treatment

- Disputed Liability – If the insurance company is trying to blame you

- Bad Faith Insurance Practices – If they are stalling, ignoring evidence, or refusing to negotiate fairly

- Complicated Claims – If multiple parties are involved or the damages are high

An attorney can handle all the back-and-forth, making sure you do not get shortchanged. Plus, most personal injury lawyers work on contingency, meaning they are not paid unless you win.

Common Challenges in Car Accident Settlements

Even if you do everything right, you might run into roadblocks. Some of the most common issues include:

Even if you do everything right, you might run into roadblocks. Some of the most common issues include:

- The Insurance Company Disputes Your Injuries – They may argue that your injuries are not as bad as you say or were pre-existing conditions.

- Comparative Negligence Reduces Your Claim – Your settlement could be reduced if you are found partially at fault.

- Delays in Payout – Some companies drag their feet when sending out checks.

- Pressure to Settle Quickly – The insurance company might push you to accept a fast payout before fully understanding your damages.

These tactics can help you stay prepared and push back against unfair delays or lowball offers.

Stay Prepared and Protect Your Claim

Negotiating a car accident settlement is difficult, but you can get a fair payout with preparation and persistence. The key is knowing your rights, backing up your claim with strong evidence, and pushing back against low offers. If the insurance company does not budge, having a legal team in your corner can make all the difference.

If you have been injured in a car accident and need help getting the settlement you deserve, Crantford Meehan is here to fight for you. Call (843) 832-1120 or contact us today via our website to get started with a free consultation.